Getting My Accounting Firm Okc To Work

Getting My Accounting Firm Okc To Work

Blog Article

4 Simple Techniques For Okc Tax Credits

Table of ContentsWhat Does Real Estate Bookkeeping Okc Do?About Okc Tax CreditsBookkeeping Okc Can Be Fun For AnyoneThe Definitive Guide for Accounting Firm OkcNot known Factual Statements About Okc Tax Deductions The 20-Second Trick For Real Estate Bookkeeping OkcThe smart Trick of Real Estate Bookkeeping Okc That Nobody is DiscussingCpa Okc Things To Know Before You Get ThisHow Accounting Okc can Save You Time, Stress, and Money.Some Of Accounting Firm Okc

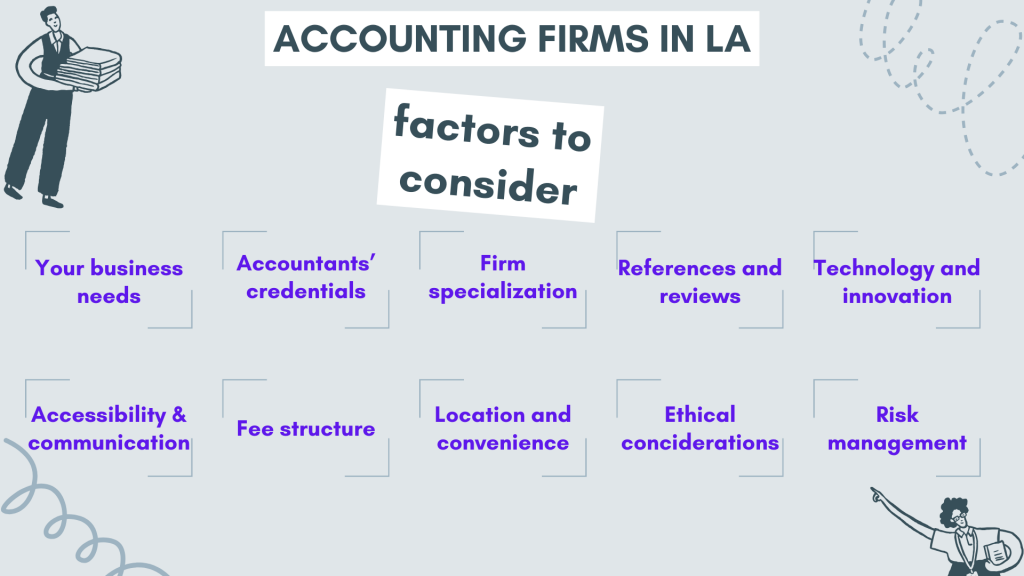

While basic services like accounting and tax preparation are fundamental, try to find firms that use additional services such as specialized accounting associated to your industry, or forensic accounting and monetary litigation support. A full-service accounting firm can provide thorough support and assistance, allowing your organization to focus on its core operations while making sure financial compliance and stability.These success stories can supply insights into the firm's problem-solving abilities and their ability to deal with varied monetary situations distinct to your field. The monetary details of your company is delicate and need to be confidential. In compliance with the IRS instruction on customer data protection, the accounting firm you select need to have robust security measures in place to safeguard your data.

The Ultimate Guide To Cpa Okc

A reputable company will prioritize the privacy and security of client information, implementing robust procedures to prevent unapproved gain access to or data breaches. Comprehending how an accounting firm determines its rates and charges is essential for budgeting purposes. Some companies charge a repaired fee for particular services, while others utilize hourly rates.

By examining these vital factors, you can make an informed choice and select an accounting partner that not only fulfills your service' immediate financial requirements, but also adds to its long-term growth and stability. If you require an accounting partner you can trust, call us now to discuss your particular requirements.

Bookkeeping Okc - The Facts

Your company is worthy of the very best financial backing something we're fully equipped to offer.

When you sit down to start investigating accounting company online, you may at first feel overwhelmed by all of the choices that are readily available. On the Google search engine alone, there are more than 17 million search results page for and almost 3 million search engine result for. There are numerous kinds of accounting-related services used by companies, including tax preparation, audit services, accounting, system style, accounting, managerial accounting, financial reporting, controller services, and more.

How typically do you need their services? Do you need someone who is regional and will work in your workplace, or are you prepared to work with a nationwide or global accounting services business?

How Tax Accountant Okc can Save You Time, Stress, and Money.

The very same survey reports that "one-in-three small companies report spending more than 80 hours. each year on federal taxes." If your accounting requirements are restricted in that you just require someone a couple of days a month, it might be best to hire somebody on a part-time basis.

You will need to find out how much you are prepared to invest in accounting services for an in-house worker vs. outsourced services. When working with a full-time employee in your office, don't forget that your expenses will include his/her annual income, taxes, health or life insurance coverage, and other staff member advantages like paid time off and company retirement contributions.

Be sure to keep in mind the expense you otherwise would pay by hiring a full-time worker or several staff members to carry out those same functions. You may be amazed to see how much money you might conserve by contracting out those services to an external group of specialists in lieu of working with an internal group.

The Main Principles Of Okc Tax Credits

It is important to decide whether you want to hire a regional, nationwide or global company to manage your accounting requirements. You may not want to hire an internationally-based firm to assist you with sticking to U.S. federal tax laws or state guidelines as they may not be as familiar with the intricacies of the U.S

Another concern is knowing with whom you will be working when hiring outsourced services.

While there are many other factors to consider to remember when choosing to employ a new employee or outsource a few of your accounting services, these standards will help get you on the right course. No matter which course you select to take, just be sure to take the essential time to research study all of your choices before making a decision.

Some Known Factual Statements About Real Estate Bookkeeping Okc

Among the most intelligent things you can do as a little service owner is selecting an accountant for your business. It goes without stating that, if you do not have a strong financial background or know much about accounting, you should not be doing your own accounting. Send out professional-looking invoices Accept online payments with ease Monitor who's paid you There are just too many issues that can develop from that attemptboth financial and legal.

It is necessary to decide whether you wish to work with a regional, national or international company to handle your accounting needs. You might not desire to hire an internationally-based firm to help you with adhering to U.S. federal tax laws or state policies as they might not be as familiar with the intricacies of the U.S.

Another concern is knowing with whom you will be working when hiring outsourced employing. Will you have devoted group members or will you be turned in between people who will not recognize with the particular requirements of your business? Discover a company that will fulfill your accounting service requirements and the level of personalized service you expect.

While there are many other considerations to remember when choosing to work with a brand-new staff member or outsource some of your accounting services, these guidelines will assist get you on the ideal course (bookkeeping OKC). Despite which path you choose to take, simply make certain to take the essential time to research study all of your alternatives before deciding

Among the most intelligent things you can do as a small company owner is picking an accounting professional for your service. It goes without saying that, if you don't have a strong monetary background or understand much about accounting, you shouldn't be doing your own accounting. Send professional-looking billings Accept online payments with ease Track who's paid you There are simply a lot of problems that can arise from that attemptboth monetary and legal.

Fascination About Business Consulting Okc

Report this page